Incentive stock options are a type of equity compensation arrangement where the employer grants the employee the right to purchase company shares in the future at a predetermined price. Most incentive stock options vest over a 4 year period.

Three Important Dates

There are three dates you need to be aware of if you have incentive stock options:

- The grant date: The date you are granted your options.

- The vesting date: The date your stock options become exercisable.

- The expiration date: The date after which you no longer can exercise your stock options.

If you do exercise your incentive stock options you should also remember to track the exercise date.

When you exercise an incentive stock option you will not owe any W-2 or payroll taxes immediately. You will however have an Alternative Minimum Tax (AMT) adjustment. The AMT is based on a parallel tax system.

Alternative Minimum Taxes and Incentive Stock Options

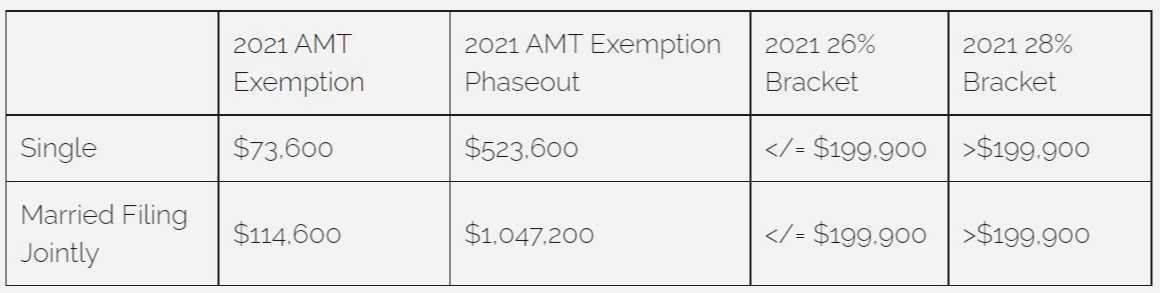

If the taxes you owe under AMT are higher than the taxes you would owe under the ordinary tax system, then you have to pay the AMT. Exercising your incentive stock options acts to increase the resulting Tentative Minimum Tax, and if it increases it high enough, you will be taxed at a rate of 26% or 28% according to the table below.

The AMT has an exemption of $73,600 (2021) or married couples filing jointly making less than $114,600 (2021). This exemption is analogous to the standard deduction under the regular tax system i.e. it lowers your income by a standard amount before applying the tax rate.

The AMT exemption is phased out by 25 cents for every dollar on amounts over $523,600 for individuals and $1,047,200 for married couples; e.g. if you made $550,000 as a single individual, your exemption will be lowered by $6,600 to $67,000.

The AMT will only affect your taxes if the amount that you owe under the regular income tax system is less than the amount you owe under the Tentative Minimum Tax. Since exercising an incentive stock option can increase your Tentative Minimum Tax, you should be careful not to exercise an amount that will subject you to AMT taxation. The larger the value of the gain on the exercised shares, relative to your income, the greater the risk you run.

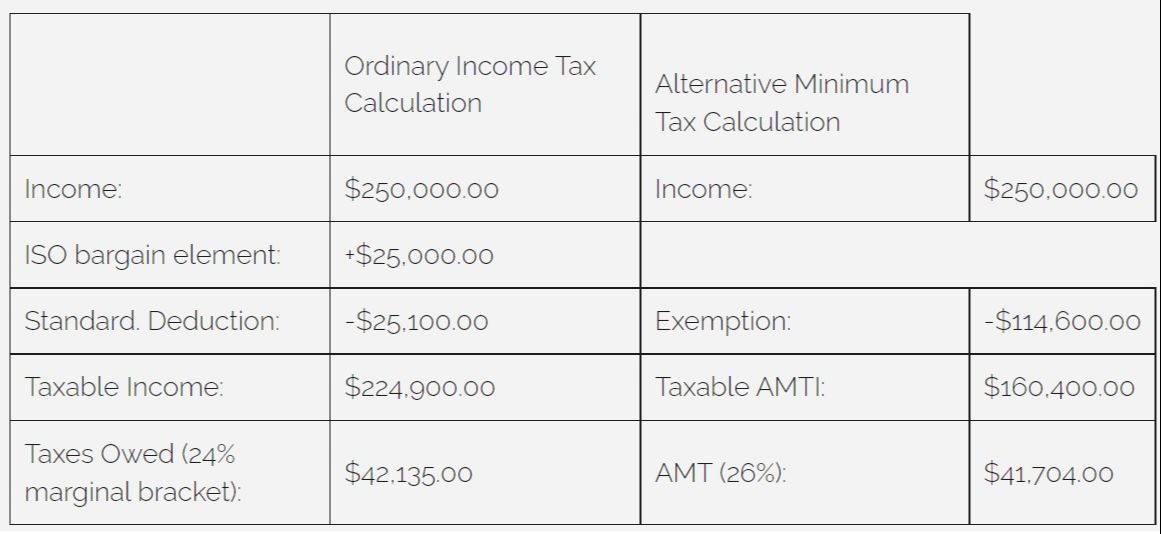

Simplified Example of how AMT is Calculated

Assume: $250,000 in income, MFJ, and taking the standard deduction

You can see from the simplified example above, the exercise of an incentive stock option with a $25,000 gain does not result in any AMT being owed because the amount due under the Ordinary Income tax system results in a larger amount.

If you are subject to AMT taxes then you can still receive a future AMT credit to help offset the capital gains taxes you will pay when you sell the shares from your exercised options.

Qualifying Disposition of Incentive Stock Options

The goal when exercising an incentive stock option is to make the exercise and sale of stock a “qualifying disposition”. Assuming you won’t be impacted by AMT considerations (less likely absent a very high income or large gain in your incentive stock option shares), then a qualifying disposition is a good goal to have.

Under a qualifying disposition, any gain in the exercised incentive stock options will be treated as a long term capital gain; which is better when compared with ordinary income (like nonqualified stock options) or AMT. In order for an exercise and sale of company stock to be a qualifying disposition, two rules must be followed:

- the company stock must be held for at least 1 year after the date of exercising the options

- the company stock must be held for at least 2 years after the date when the options were granted

Assuming you meet these two conditions, you will only owe long term capital gains on your incentive stock option income.

Simplified Example of a Qualifying Disposition:

You are granted incentive stock options for 100 shares with an exercise price of $25/share on 01/01/2015. After 5 years on 01/01/2020, you exercise the options when the company stock price is at $50/share. You will have no tax consequences until you sell the shares from the exercised options. You sell the shares on 01/02/2021 for $55/share. Doing this you will only owe long term capital gains of (55-25)*100 = $3000.00 taxed at a 15% rate or $450 instead of the $720 (24% marginal rate) you would owe were you to make a disqualifying disposition.

Note: If you exercise your incentive stock options under a cashless exercise then you will automatically lose qualifying disposition status on the shares that are immediately sold to cover the purchase cost. Therefore, for maximum tax benefit, you should ensure that you have enough cash on hand to exercise your incentive stock options.

Failing to meet the qualifying disposition requirements will result in a disqualifying disposition. A disqualifying disposition will mean that any gain on exercised incentive stock options (current market price – exercise price) will be treated as ordinary income (but not Medicare and Social Security taxes). This means that instead of being taxed at lower capital gains tax rates, you will owe your higher marginal income tax rate.

It should be noted that sometimes, there are reasons why a person might not want a qualifying disposition. Indeed some folks dislike the idea of having to hold their company’s shares for at least a year and would prefer to capture their profit immediately.

Others may be willing to forgo a qualifying disposition because the person does not have the cash on hand to make the purchase of their shares at the exercise price.

You should ask your tax advisor if you are unsure whether a qualifying disposition would be beneficial to you or not.

Exercising Incentive Stock Options

When you exercise your incentive stock options you will have to buy the shares at the exercise price and either hold them (for a qualifying disposition) or sell them. Having the cash on hand to purchase the securities will allow you to maximize the tax benefits of having incentive stock options.

At the same time, you don’t want to be subject to the alternative minimum tax (AMT) if you don’t have to. The higher the gain in your incentive stock options as a proportion of your regular income the more likely you are to run into AMT considerations.

Remember that the gain you are calculating for tax purposes is the Market Price minus the

Exercise (strike) Price. This is called the bargain element.

Some people who are concerned about running into the AMT rules will exercise their employee stock options up to the cutoff point where AMT comes into play. Here’s an example:

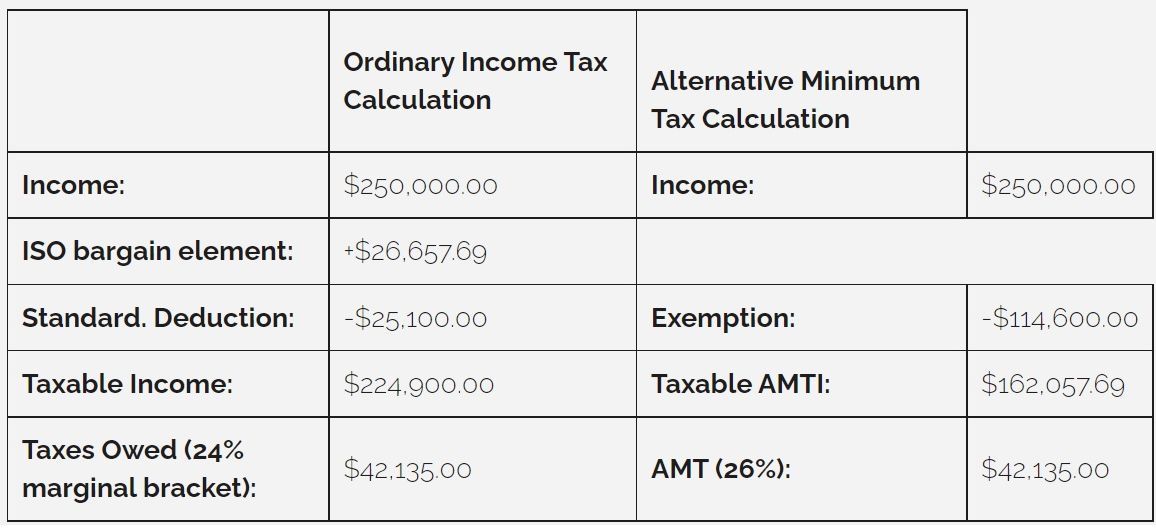

Simplified Example of Exercising Incentive Stock Option to AMT Point

Assume: $250,000 in income, MFJ, and taking the standard deduction

Below is the table from our example above. If we wanted to know how many of our options we could exercise before running into the AMT we would first want to calculate our standard income tax.

You can get a rough estimate by taking your salary, subtracting any pre-tax retirement contributions, then subtracting the standard deduction (assuming you use the standard deduction).

After you’ve done that you will want to remember that income taxes are tiered so your entire income isn’t subjected to your marginal tax rate e.g. 10% on the first $19,900, 12% on $19901 – $81050, etc. (2021 married filing jointly rates)

Next you will want to divide your calculated income tax total by .26 (for the 26% AMT rate or 28% if you fall into that category. The resulting number is the highest AMT income that you can have before AMT applies.

With this number, you add your AMT exemption ($114,600 in this case) and finally subtract your salary. What you are left with is the maximum amount of “bargain element” (market price minus exercise prices times the number of shares exercised) you can exercise without being subject to AMT rules.

Now that you know the maximum amount of bargain element you can exercise without being subject to AMT, all you need to do is find the number of exercised shares that will get you there.

First take the current market price per share of the company stock and subtract the exercise price per share; this is your bargain element per share. Divide your maximum bargain element that we calculated earlier by the bargain element per share figure and the result should be the number of shares you can exercise without running into AMT consequences.

Besides maximizing what you can exercise without being subject to AMT consequences, this strategy also starts the clock on your qualifying disposition countdown.

This isn’t the only strategy for exercising incentive stock options, there are many.

For those folks, it would make more sense to forgo the

I highly recommend talking to your CPA or a CFP® before trying to do any of these calculations on your own as there can be many contingencies that need to be accounted for.

Expiration of Incentive Stock Options

Whether you decide to exercise your incentive stock options as the become available, or exercise as many as you can up to the AMT threshold, you will definitely want to exercise your incentive stock options before expiration.

When your incentive stock options expire, they are no longer available to be exercised meaning you have completely lost that income. This can be easily avoided by planning early and paying attention to the date your options vest and the date they expire.

If you leave your company before your options vest, you will likely lose the ability to exercise them as well. However if you have vested options, you will likely have a window of opportunity to exercise your options once you’ve left.

None of the information in this document should be considered as tax advice. You should consult your tax advisor for information concerning your individual situation.